Owner Resource Group is pleased to provide the following wealth management insights from Round Table Wealth Management

Second Quarter 2022 Review

Dear Clients and Friends,

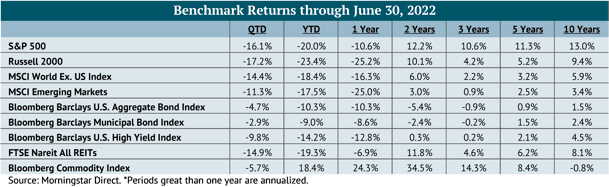

The confluence of global economic and geopolitical issues culminated into a particularly challenging environment for capital markets during the first half of 2022. Inflation, interest rates, and the growing threat of a recession, not to mention ongoing war in Ukraine, have increased risk premiums across both equity and fixed income asset classes. While the performance of equities and fixed income is disheartening, the history of markets has demonstrated that ultimately markets rebound and those that remain invested are aptly rewarded.

We have not stood idly by as risks increased over the past one-year and year-to-date. We have increasingly allocated towards lower valuation, value-style investments and increased the use of hedged equity index exchange traded funds to the largest extent in firm history. Within fixed income, the threat of higher interest rates led us to maintain shorter duration bond exposure complemented by floating rate loans, whose interest rates rise as markets rates increase. We sensed the potential for inflation in the spring of 2021 and added real assets and commodity exposure to portfolios. While our actions have not alleviated all the downside risk and unrealized declines in portfolios, these actions have provided some tempering of the drawdowns.

Remembering that markets work in cycles, we must also remain ready for a shift in the cycle where the future bull market replaces the current bear market.

The Big Picture

U.S. real gross domestic product declined approximately 0.9% based on the advanced estimate of second quarter 2022 growth, which by rule of thumb suggests the U.S. is in an unofficial, technical recession. This outcome, now realized, in many ways is not shocking to investors. Currently, investors estimate the probability of an official recession occurring within the next 12 months at one of the highest probabilities since prior to the pandemic. A key driver of recession concerns is the increased aggressiveness by the Federal Reserve in both communication and actions as they seek to tamp down inflation. The Federal Reserve recently increased its Fed Funds Rate by 0.75% at its July rate setting committee meeting (bringing the Fed Rate to 2.5%) and it is largely anticipated that another increase will occur at its next rate setting meeting. Importantly, Chairman Powell previously acknowledged that the Fed’s ability to mastermind a “soft landing” will be a risky maneuver, but the long-term benefits of quelling inflation outweigh the short-term pain that could occur in accomplishing its objective. Investors have taken this to indicate that the Fed is willing to push the economy into recession, to avoid long-term embedded inflation expectations that are economically destabilizing and counter to the Fed’s dual mandate.

The probability of a recession is not reflected in the Philadelphia Federal Reserve’s Survey of Professional Forecasters, which shows no recession over the next two years, despite greatly reduced GDP growth rates. Consumer spending is about 70% of the U.S. economy and economists are expecting a slowdown in personal expenditures, which influences the survey’s GDP projections. We believe it is a reasonable likelihood that consumer spending slows, which will have an impact on corporate earnings. Investors have witnessed valuations decline rapidly throughout the year; however, earnings for equity indices such as the S&P 500 Index have increased year-to-date and remain robust. This dynamic creates a concern as the certainty of achieving those earnings is called into question and raises the possibility that future earnings declines could create the second leg of this year’s drawdown.

Whether market valuations reflect a potential recession is questionable because market valuation fundamentals over the past 10 to 15 years were supported by historically low interest rates and benign levels of inflation. Today, market consensus and Federal Reserve statements suggest short-term interest rates will continue to go higher and surpass recent highs. Inflation is a key variable and will influence the Fed’s rate setting actions—recession or not. Reflecting again on market data, breakeven levels of expected inflation, calculated as the difference between nominal U.S. Treasury Bonds and U.S. Treasury Inflation Protected Securities (TIPS), imply the average inflation rate over the next two years is approximately 3.4%, a material reduction from the current headline inflation figure of 9.1%. We would obviously be very pleased to see inflation levels drop to those projected breakeven levels with the likelihood that the Fed would become less aggressive in raising interest rates. Such a development may help set the foundation for the next equity bull market and even help longer duration fixed income. Unfortunately, we are not there yet.

Our outlook continues to be cautious as inflation remains high and the Fed maintains its aggressive stance. Second, we cannot ignore the impact that the war in Ukraine has had on commodity prices and felt by U.S. consumers through food and gasoline/energy prices. (Food at home increased 12.2% for the twelve months ending June 2022 while gasoline increased 59.9% over the same period). Regional Federal Reserve offices as reported in the quarterly Beige Book, report consumers substituting down in brands and reducing the volume of expenditures. Despite this troubling data, for investors, this data becomes one of the “known, knowns” and market participants will begin to focus on the post-recession environment, which may include lower or stable interest rates and lower levels of inflation. Generally speaking, every new bull market begins this way, and our approach is to capture opportunity as it emerges.

The Outlook

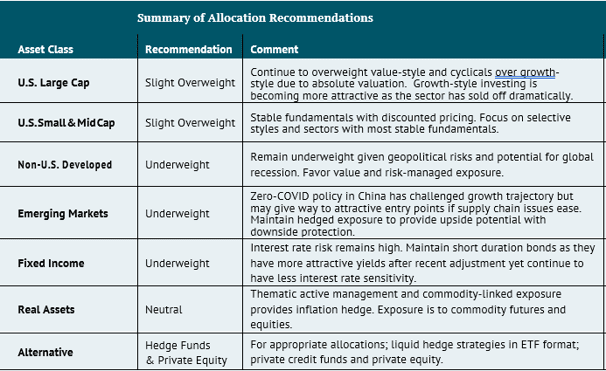

We continue to hold a slight overweight to U.S. Large Cap equities with a current overweight to value-style investments relative to growth. Beyond the near term, it is our expectation that the market will soon look past the recession toward an environment that is likely to see the Fed pause interest rate increases, which will be a tailwind for growth investments. For the year-to-date, value-style investments represented by the Russell 1000 Value Index (RLV) were down 12.9% while growth investments represented by the Russell 1000 Growth Index (RLG) were down 28.1%. Equity valuations in the growth-style index have declined materially since the start of the year but remain at an 8.2% premium relative to its 10-year average of 25.7x trailing 12-month earnings. The Russell 1000 Value Index by contrast is selling at a 11.9% discount to its 10-year P/E average of 17.7x. Projected earnings growth over the next two years for the RLV and RLG, is 10.6% and 18.2%, respectively, but investors should exercise caution in assigning too much certainty to these figures as the Fed’s ability to conduct a “soft landing” will likely impact these projections. Consequently, we are also maintaining a meaningful allocation to a hedged S&P 500 exchange traded fund to capture potential upside but also limit market volatility relative to the underlying index. We have recently introduced a hedged NASDAQ 100 allocation, where appropriate, to marginally begin a reallocation to include more growth-style exposure.

We maintain a slight overweight to the small and mid-cap asset class due to attractive relative valuations brought on by the drawdown experienced year-to-date. The Russell 2000 Index has suffered nearly a 32% drawdown from its peak in early-November of last year through mid-June of this year, which is on par with the median drawdown the index experienced during the last 12 bear markets and approaching the average drawdown of 36% experienced during a recession. Yet despite all this negative performance, the reality is that companies continue to execute on growth expectations with 23.5% earnings growth posted in the first quarter and 4.1% expected for the second quarter. Additionally, the third and fourth quarter year-over-year earnings estimates have remained stable for much of 2022, hovering around the low to mid-teens for each quarter. While a recession would likely impact the expected earnings, potentially as early as the second half of this year or in 2023, price performance suggests that much of this concern may already be reflected in the current prices as the valuation on the S&P 600 has fallen to recession level lows of 11.4x as of quarter-end. All else equal, for valuations to return to the average of 17.2x since 2000, next-twelve-month earnings would need to decline nearly 19% over the next twelve months rather than experience the expected earnings increase of approximately 18% over that same time period. To put that in context, earnings decreased nearly 28% in 2020 peak-to-trough and a recession to the same magnitude does not appear to be warranted this time around.

We continue to maintain an underweight allocation to international equities, both in developed markets as well as emerging markets, as global risks remain elevated. Year-to-date, developed markets have declined 18.2%, as mounting risks from inflation, the war in Ukraine, and a strong U.S. Dollar have hindered asset class performance. In Europe, the most recent inflation reading came in at 8.6%, with energy prices as the biggest contributor to the increase. With no resolution or negotiation to end the war in Ukraine imminent, we believe inflation will remain elevated or increase further in the region over the near-term, applying persistent pressure to consumer spending habits and the profit margins of global corporations. The market sell-off during the first half of the year compressed valuations in the asset class to near historical lows. The forward price-to-earnings multiple for the MSCI World ex. USA Index was 11.5x at quarter end. This represents a 20% discount to its 10-year average, and the lowest valuation during the 10-year period. While these depressed valuations reduce the potential for further valuation compression, it is not necessarily a prediction that markets will rally off these lows as a result. It is likely we will see earnings retreat from current estimates during the second half of the year, particularly if a recession is realized. If this scenario materializes, valuations will either trend higher as a result of a lower “E” or maintain a similar P/E level as prices reflect the new earnings environment. Ultimately, we remain biased toward hedged equity exposure to protect against future volatility and the risk of a global recession.

We also maintain an underweight allocation to emerging markets, although the outlook is mixed as economic dynamics have evolved over the course of the year. China, the biggest influencer within emerging markets, remains challenged from mass COVID lockdowns across major cities like Shanghai and Beijing and has kept supply chains strained as a result. To counteract the economic weakness from these restrictive health measures, the Chinese government has eased fiscal and monetary policy at a time when other central banks have aggressively been tightening policy to quell inflation concerns. This led to stabilization in Chinese equities during the second quarter. In other regions, such as Latin America, equity markets have been relatively bright during the first half of the year, benefitting from surging commodity prices. However, the cyclicality of these economies remains dependent on the path of commodities and as oil prices eased in June, these markets sold off over 20% in the second quarter, giving back all the gains from earlier in the year. Given the continued uncertainties within emerging markets and the global recession risk, we remain focused in hedged equity exposure in the asset class.

We are maintaining our underweight to fixed income as interest rate volatility remains elevated along with the risk of higher interest rates. We are inclined to continue holding this view until we see concrete signs that inflation is easing. However, with the Fed firmly in a rate rising cycle, investors are once again being offered yield on ultra-short and short-term investments with less interest rates sensitively compared to longer-term fixed income investments. We continue to see value in short-term fixed income investments as they offer comparable yields to longer duration investments and more flexibility to roll capital in the future should rates continue to move higher. For investors with idle cash, ultra-short fixed income can be an attractive way to generate more attractive annual yields of as much as 2%. From a credit perspective, we also reiterate an overweight to below investment grade loans where appropriate to capture added yield premiums while maintaining short-duration exposure. While the increase of recession has increased spreads within corporate bonds, we anticipate a relatively subdued default cycle in the event of a recession as less than 10% of high yield debt outstanding matures by year-end 2024, allowing for many companies to have maintain stable balance sheets should a recession occur before then.

We are maintaining our exposure to the commodity sector and moderating recommended exposure to select real assets. The allocation to real assets was in part premised on the ability of Washington to pass a larger infrastructure bill (after the $1.2 billion Infrastructure and Jobs Act) that would benefit shares of real asset companies. The probability of this has diminished and not likely to occur due to historically high inflation rates and the upward inflation pressure that could occur if legislation were to pass.

*The content herein is provided to you by unaffiliated sources believed to be reliable, but not guaranteed on an as-is basis without any warranties of any kind. In no event shall Owner Resource Group, LLC be liable for any direct, indirect, incidental, punitive, or consequential damages of any kind whatsoever with respect to this content. The content is distributed for informational purposes only and not intended to provide investment advice. The information contained in this article is accurate as of the data submitted, but is subject to change. We strongly recommend you consult your professional business advisors before making any financial or investment decisions.